Chidambaram Slams Govt Over GDP Growth Forecast

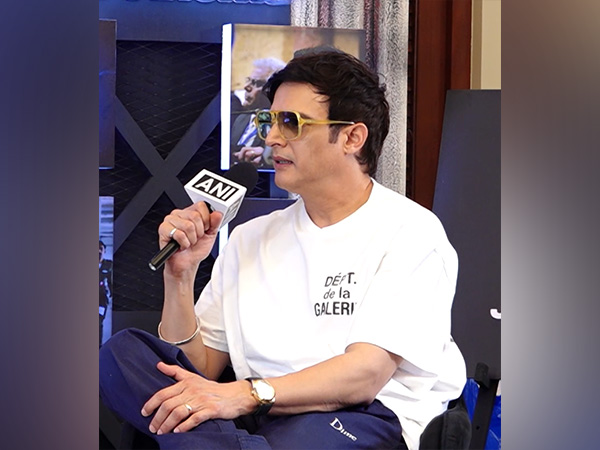

As the Reserve Bank of India (RBI) revised gross domestic product (GDP) growth projection for the current financial year 2019-20 to 5 per cent from its earlier forecast of 6.1 per cent, former Finance Minister and senior Congress leader P Chidambaram said that this is “unprecedented”.

“Today, for the first time the Reserve Bank of India in a matter of seven months has reduced its forecast from the original 7.4 that was made in February 2019, reduced to 7.2 in April 2019, reduced to 6.1 a month ago and today reduced to 5. I cannot recall an instance where between February 2019 and December 2019, the RBI reduced its forecast from 7.4 to 5,” Chidambaram told media here.

“This is unprecedented. Either the RBI was completely incompetent in making its first assessment in February 2019 or the government has been extremely incompetent in managing the economy in the last eight months,” he added.

The RBI on Thursday kept repo rate unchanged at the current 5.15 per cent level but revised gross domestic product (GDP) growth projection for the current financial year 2019-20 to 5 per cent.

Consequently, the reverse repo rate under liquidity adjustment facility remains at 4.9 per cent with marginal standing facility rate and bank rate at 5.4 per cent.

“The RBI’s Monetary Policy Committee (MPC) recognises that there is monetary policy space for future action,” said RBI Governor Shaktikanta Das.

“However, given the evolving growth-inflation dynamics, the MPC felt it appropriate to take a pause at this juncture. Accordingly, the MPC decided to keep the policy repo rate unchanged and continue with the accommodative stance as long as it is necessary to revive growth while ensuring that inflation remains within the target.”

“These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of plus or minus 2 per cent while supporting growth,” said Das.

Repo rate is the rate at which the RBI lends money to commercial banks. A repo rate cut allows banks to reduce interest rates for consumers and lowers equal monthly instalments on home loans, car loans and personal loans.

(ANI)