AIBA Writes To Prez, Seeks Presidential Reference To SC On Electoral Bonds Scheme

The All India Bar Association (AIBA) on Tuesday wrote a letter to the President of India and requested for Presidential Reference to the Supreme Court of India on the Electoral Bonds scheme under Article 143 of the Constitution of India.

It submitted that the Supreme Court of India passed a verdict of far-reaching consequences on February 15, 2024 invalidating the Government of India’s Electoral Bonds Scheme. It also ordered the State Bank of India to hand over details of the corporate contributions received by political parties by March 6, 2024 and further directed the Election Commission of India to make public the details.

On March 11, 2024, when the State Bank of India sought time till June 30, 2024 to disclose the Corporate Contributions, citing the complexity of the process, the Supreme Court rejected the plea and tasked the nation’s largest Bank to reveal the information by March 12, 2024 so as to enable the Election Commission of India to make public all details by March 15, 2024.

Senior Advocate Dr Adish Aggarwala, Chairman of AIBA and a President of the Supreme Court Bar Association stated that, it is my duty to lay before you these facts and seek a Presidential Reference on the issue of the Electoral Bonds case, so that the entire proceedings could be reheard and complete justice could be ensured to the Parliament of India, political parties, corporates and the general public.

The petitioners invoked Article 32 of the Constitution and challenged the constitutional validity of the Electoral Bond Scheme, which paved the way for anonymous financial contributions to political parties. The petitioners have also challenged the provisions of the Finance Act, 2017 which, among other things, amended the provisions of the Reserve Bank of India Act, 1934, the Representation of the People Act, 1951, the Income Tax Act, 1961, and the Companies Act, 2013.

By way of a 232-page judgment, the Supreme Court bench headed by the Chief Justice of India, struck down the Scheme on February 15.

“Madam President, the Supreme Court of India is well within its right to hear any dispute or constitutional question of law brought before it for adjudication. Similarly, the bedrock of the Supreme Court’s exalted constitutional status is Article 142 of the Constitution. Article 142 confers upon the Hon’ble Supreme Court the inherent power to render ‘complete justice’ stated Dr Adish Aggarwala,” the letter added.

The Supreme Court of India, therefore, should not allow itself to deliver judgments that would create a constitutional stalemate, undermine the majesty of the Parliament of India, the collective wisdom of the people’s representatives gathered in the Parliament and create a question mark over the very democratic functioning of political parties themselves.

The corporate donations scheme was brought forth because of the absence of poll funding mechanism in our nation, and in order to enable political parties to resort to lawful methods to augment resources for poll purposes.

The electoral bond scheme came into effect due to the provisions of the Finance Act, 2017 which, among other things, amended the provisions of the Reserve Bank of India Act, 1934, the Representation of the People Act, 1951, the Income Tax Act, 1961, and the Companies Act. 2013.

Therefore, it would be perverse to doubt the legislative intention behind the scheme. Of course, the four writ petitions — Writ Petition (C) No. 880 of 2017 Association for Democratic Reforms & Anr, Writ Petition (C) No. 59 of 2018, Writ Petition (C) No. 975 of 2022 and Writ Petition (C) No. 1132 of 2022 – challenged the constitutionality of the scheme.

By an order dated April 12, 2019, the Hon’ble Supreme Court delivered an interim order, which is as follows: “In the above perspective, according to us, the just and proper interim direction would be to require all the political parties who have received donations through Electoral Bonds to submit to the Election Commission of India in sealed cover, detailed particulars of the donors as against the each Bond; the amount of each such Bond and the full particulars of the credit received against each Bond, namely, the particulars of the bank account to which the amount has been credited and the date of each such credit.”

Madam President, the interim order dated April 12, 2019 nowhere mentions that any more receipt of corporate contributions by way of the electoral Bonds was subject to the outcome of the writ petitions challenging the scheme. As on the date of filing of these writ petitions as well as on the date of the interim orders were delivered, the Electoral Bonds Scheme was a perfectly legal and constitutional fund-raising scheme provided by the government and the Parliament of India. It was only on February 15, 2024 that the Scheme was invalidated and further sale of the Bonds was prohibited.

It makes two things clear: one, the 22,217 Electoral Bonds that had been received by different political parties from different corporate entities by way of corporate contributions were perfectly legal and constitutional. How can a corporate entity be punished for having played by Rule valid and legal on the day the contributions were made?

Two: Even if the Supreme Court prohibited the Electoral Bonds Scheme, the prohibition shall come into effect only prospectively, and not retrospectively. The Honb’le Supreme Court itself has penned umpteen judgments holding and reiterating the constitutional position that laws and rulings would take only prospective effect, and not retrospective effect. This is more aptly applicable in the Electoral Bonds Scheme case because there was no interim order either prohibiting or making such bonds subject to the outcome of the writ petitions.

When there was no legal or constitutional bar, and when there was express provisions and amended laws that enabled corporate entities to make contributions, how could they now be faulted and punished.

Madam President, Indian laws define the term ‘Donation’ as follows:

“A donation is a voluntary transfer of property (often money) from the transferor (donor) to the transferee (donee) with no exchange value (consideration) on the part of the recipient (donee).”

A donation, therefore, is a voluntary transfer of resources without any consideration. A voluntary act cannot be sought to be made an act of compulsion merely because one corporate entity contributed different quantum of donations to different political parties. Or because some corporate entity made ‘voluntary donation’ to only one party, and nothing to other parties.

Donation cannot be conditional on both sides. A donor cannot be asked to maintain uniformity of donation to more than one party, as it would infringe on the voluntary aspect of the act. It would amount to compulsion.

While so, the Supreme Court has penned this verdict on the premise that donors cherry-picked donees for a consideration. Assuming, not admitting, that the donation was an act of quid pro quo, how will uniform contribution to all political parties would undo the ‘consideration’, if any, part of the corporate intention? In other words, even if getting a return favour is the intention behind the donation, by compelling the donor to donate resources equally to all political parties will not undo the intention. Neither will it be exacerbated by choosing one or two political parties for larger donations.

Madam President, the most dangerous part of the Hon’ble Supreme Court’s judgment in the Electoral Bonds Scheme case is its direction to the Election Commission of India to correlate the donations and make public which political party received how much from which corporate entity. It has a potential to sound a death-knell to both parliamentary democracy and corporate freedom in our nation.

Corporate’s donated through purchase of 22,217 corporate Bonds with the State Bank of India, and their legitimate expectation was the discretion guaranteed to them. Infringing their right against disclosure of either their name or the quantum of their donation or to the parties they had chosen differential contributions will amount to betrayal of a constitutional trust and sovereign guarantee.

Revealing the names of corporates that had contributed to different political parties would render the corporates vulnerable for victimization. The possibility of them being singled out by those parties that had received less contribution from them, and harassed cannot be ruled out if the names of corporates and their quantum of contributions to various parties are revealed. This will be reneging on the promise given to them while accepting their voluntary contributions.

Disclosing such sensitive information, that too retrospectively, will result in chilling effect in corporate donations and participation in the democratic process. Besides drying up further donations, such an act would discourage and dissuade foreign corporate entities from setting shops in India or participating in the democratic process but contributing to winning horses.

If we enforce this judgment of the Hon’ble Supreme Court of India by retrospectively, releasing all sensitive information, it will shatter the reputation the nation enjoys in the international arena.

Madam President, Article 143 of the Constitution confers advisory jurisdiction on the Hon’ble Supreme Court and provides for the power of the Hon’ble President of India to consult the Hon’ble Supreme Court; it says that if it appears to the Hon’ble President that a question of law or fact has arisen, or can arise in future which is of public importance and it is beneficial to obtain the opinion of the Hon’ble Supreme Court, he may refer the question for consideration and the Hon’ble Supreme Court may, after such hearing, report to the President its opinion, said Dr Adish Aggarwala. (ANI)

For more details visit us: https://lokmarg.com/

‘Really Happy for You, Chetta’: Virat Kohli Praises Sanju Samson’s T20WC Performance

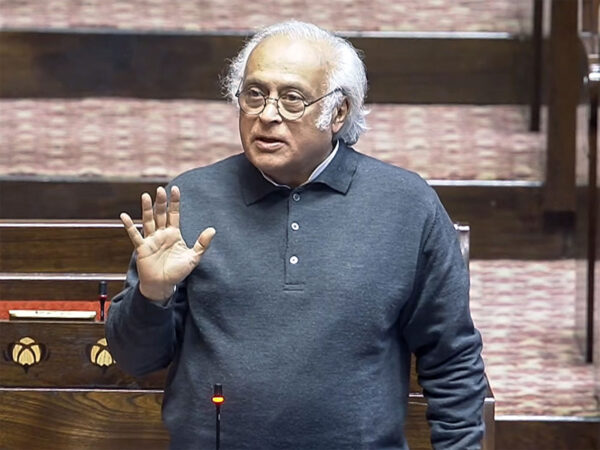

Jairam Ramesh Says Oppn Demand ‘Full-Fledge’ Parliament Debate On West Asia Conflict

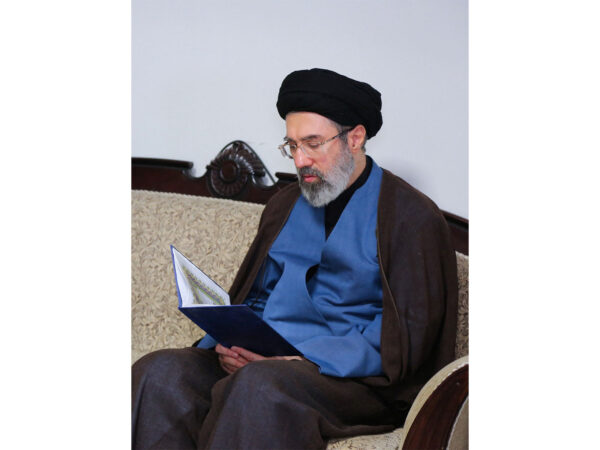

Seyyed Mojtaba Khamenei Announced As New Supreme Leader, Reports State Media