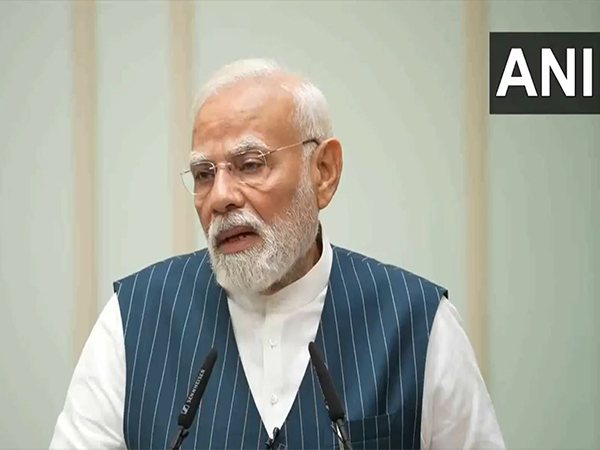

Modi Calls GST Reforms ‘Double Dhamaka Of Happiness’ Ahead Of Diwali

Prime Minister Narendra Modi on Thursday said that the upcoming GST reforms mark a significant step in making India self-reliant, calling them the “next-generation” of changes required to strengthen the economy and ease compliance for citizens and a “double dhamaka” of happiness before this Diwali and Chhath Puja.

Announcing the implementation date, PM Modi said the simplified GST regime will take effect on September 22, the first day of Navratri.

Reiterating his Independence Day address, the Prime Minister said, “Without timely changes, we cannot give our country its rightful place in today’s global situation. I had said from the Red Fort on 15 August this time that it is crucial to undertake next-generation reforms to make India self-reliant. I had also promised the countrymen that there would be a double dhamaka of happiness before this Diwali and Chhath Puja…”

“Now GST has become even simpler… On 22 September, which is the first day of Navratri, the next gen reform will be implemented as all these things are definitely related to the ‘Matrishakti’,” he added.

“This time, the festivity of Dhanteras will also be even more vibrant. Because the tax on dozens of items has now been reduced significantly. 8 years ago, when GST was implemented, a dream of several decades was realized. It was one of the biggest economic reforms in independent India,” he said further.

PM referred to GST reforms as a double dose for support and growth of the country.

“In the 21st century, as India moves forward, next-generation reform has also been carried out in GST. GST 2.0 is a double dose of support and growth for the country. The new GST reforms will bring tremendous benefits to every family in the country. The poor, neo middle class, middle class women, students, farmers, youth… everyone will get tremendous benefits from reducing GST tax,” he said.

The landmark next-generation GST reforms that were announced on Wednesday include significant relief to citizens in the healthcare and insurance sectors. One of the biggest announcements is the complete removal of GST on individual health and life insurance.

Until now, they have attracted 18 per cent GST. With the new reform, they have been moved to the zero-tax bracket, making health and life insurance more affordable and accessible to a wider section of society.

These reforms, cleared by the GST Council, are expected to reduce the cost of essential medical items and health-related financial services. In addition to this, GST rates on several critical medical items have been reduced from 12 per cent to just 5 per cent.

They include a thermometer, medical-grade oxygen, all diagnostic kits and reagents, glucometers and test strips, as well as corrective spectacles. (ANI)