Private Sector Must Share Excessive Profits With Employees To Boost Growth: CEA

Chief Economic Adviser Anantha Nageswaran painted a stark picture of how Indian corporates are compensating their workers and employees, and called for a more equitable distribution of incomes.

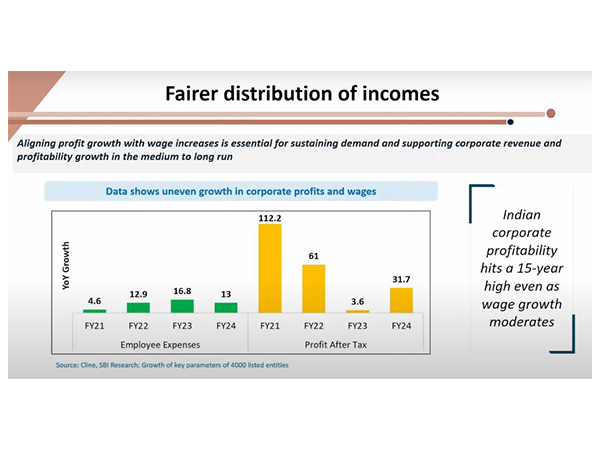

“If you look at the growth in profitability and the growth in employment expense – a combination of hiring and compensation – there is a huge disparity between the two, which has been highlighted by several private players themselves in the last few months,” said Nageswaran at a press conference.

Achieving the status of a developed economy by 2047 will require a socially responsible private sector, he said.

Sharing an anecdote going back to 1960s while quoting founder of Ford Motor Company Henry Ford, the

CEA said the auto business head had then raised the minimum wage of the labors.

Henry Ford knew that the cars he was manufacturing won’t sell if the wage growth remained steady. Henry Ford understood that “there will not be enough people to buy the cars that the Ford Motor produces”, he said.

Against that backdrop, CEA Nageswaran said that raising wage and salary for workers is also a source to raise demand in the medium run.

“It is enlightened self-interest rather than being seen from the moral prism,” the CEA noted.

Corporate profitability in India soared to a 15-year peak in 2023-24, fuelled by robust growth in financials, energy, and automobiles. Among Nifty 500 companies, the profit-to-GDP ratio surged from 2.1 per cent in 2002-03 to 4.8 per cent in 2023-24, the highest since 2007-08.

However, while profits surged, wages lagged. Quoting a State Bank of India (SBI) analysis, the Economic Survey tabled in Parliament today, asserted that 4,000 listed companies recorded a modest 6 per cent revenue growth. At the same time, employee expenses rose only 13 per cent – down from 17 per cent in 2022-23 – highlighting a sharp focus on cost-cutting over workforce expansion.

This uneven growth trajectory raises critical concerns. Wage stagnation is pronounced, particularly at entry-level IT positions.

“While the labour share of GVA shows a slight uptick, the disproportionate rise in corporate profits–predominantly among large firms–raises concerns about income inequality,” the Economic Survey read.

“A higher profit share and stagnant wage growth risk slowing the economy by curbing demand. Sustained economic growth hinges on bolstering employment incomes, which directly fuel consumer spending, spurring investment in production capacity.”

To secure long-term stability, a fair and reasonable distribution of income between capital and labour is imperative, it suggested. It is essential for sustaining demand and supporting corporate revenue and profitability growth in the medium to long run. (ANI)