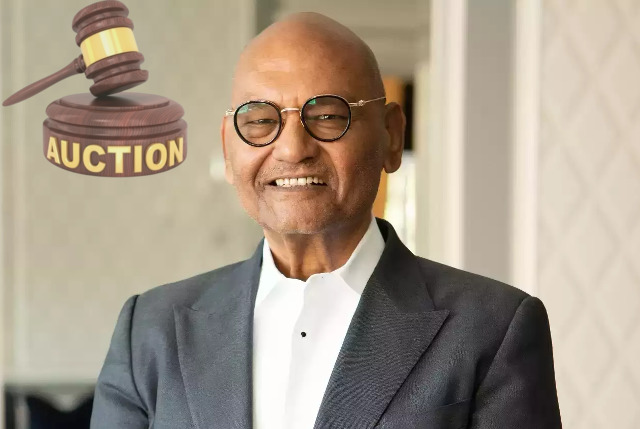

Why Anil Agarwal Has A Bone To Pick With Mining Policy

The boy from Bihar with humble beginnings who on his own admission had difficulty in conversing in English when he moved to the then Bombay in search of fortune is today among the leading lights of Indian industry with considerable ownership of assets here and abroad. He is the irrepressible Anil Agarwal, the promoter and driving force of the Vedanta Group with significant presence in sectors from aluminium to zinc to copper to iron ore mining to energy. While in zinc he enjoys monopoly status by virtue of his majority ownership of Hindustan Zinc (the government retains 29.5 per cent following divesting 64.9 per cent to Vedanta in tranches), Agarwal has the largest aluminium smelting capacity surpassing that of Hindalco and government owned Nalco.

Though an ardent admirer of prime minister Narendra Modi for his commitment to make India a developed country (Viksit Bharat) by 2047, coinciding with 100 years of Independence, Agarwal could at times also become a critic of the government. Trust him to have occasions to tell New Delhi where its policies, according to him, are not in alignment with realizing growth potential in oil and gas exploration and production and mining, particularly iron ore. At times Agarwal will go overboard in his disapproval of official policies relating to his areas of work.

This disposition of Agarwal once again became manifest when the other day Agarwal had a go against the government’s iron ore mines auction policy that has obliged the successful bidders to pay extraordinarily high auction premiums to governments of states where the mines are located. The phenomenon, he says, is found responsible for the “death” of the iron ore industry. In a post on X platform, Agarwal bemoans: “Could you run a business successfully if you have to share more than 100 per cent of your revenue with another party? I doubt if anyone would say yes. But this is the reality of India’s iron ore industry today. And it is dying.”

Agarwal like many others in the industry is nursing a grudge against intense competition for mines among bidders, including steel companies. Such competition obviously results in high auction bids that decide the premium the winning party will have to pay the concerned state government. A burden that will inevitably spell the ruin of mining groups, according to Agarwal.

Whatever their reservations about the premium, industry officials cannot contest the merits of auction of mines that ushered in transparency ending any kind of distribution of favour that was associated with the earlier regime of first come, first served. Even then Agarwal will contend that because of the high premium, “a well-meaning policy (read auction) has gone wrong.” Developing the point, he says: “The government had introduced auctions in mining for greater transparency. But when only limited blocks are on offer and so many steel manufacturers seek raw material security, there is a huge demand-supply mismatch and bid prices become massive.” India has more than a century old tradition of steelmakers owning iron ore mines to become self-reliant in this critical input.

The two shining examples are Tata Steel and IISCO (now part of SAIL). Public sector undertaking SAIL with ownership of five integrated mills and three special steel plants meets its full requirement of iron ore from its captive mines as Tata Steel does. But more recently Tata Steel had to buy ore from NMDC besides resorting to imports. Since the introduction of auction for blocks allocation, Tata Steel CEO and MD TV Narendran, unlike some of his peers, has not gone overboard in placing bids and then regret later. At the same time, since Tata Steel has targeted capacity growth to 40m tonnes by 2030, Narendran is expected to remain in hunt for new iron ore mines in order not to depend on procurement from outside.

In their search for raw material security other steel groups have had occasions to throw caution to the wind for new iron ore blocks as they come under the hammer. When Tata Steel acquired lossmaking Neelachal Ispat in July 2022 at a consideration of Rs12,100 crore, two important considerations for it were, the targeted company offered scope to expand capacity of long steel products to 10m tonnes in phases and good quality iron ore reserves of approximately 110m tonnes in Sundargarh and Keonjhar districts of Odisha. For compelling commercial consideration, all major steel groups in the country are constantly on the lookout for opportunities to pile up on reserves of iron ore. One obvious consideration is to seek protection from fluctuations in the steelmaking ingredient.

In a recent market survey, the Competition Commission of India has found that the number of iron ore mines captive to steel companies is on the rise. The mines ministry rebuttal, sharp and prompt, of Agarwal censure of high auction prices (the determinant of premium paid to the government) was expected. In its affirmation that auction premium is not paid out of total revenue of the company, the ministry tweet says: “No mining company in India shares 100% of company revenue with the Government! The auction premium paid by a company is a percentage of the average of the ex-mine prices of iron ore produced by all the mines in a state, excluding the expenditure made by the company outside lease boundary and on value addition for steel production.” The premium paid by captive mine owners is the least painful for steel groups since the share of iron ore in total production cost of steel is around 15 per cent.

For them, the trade-off could not be any better, for they will be paying “a small percentage of total value of steel produced as auction premium” securing them in the process assured supply of the mineral. In an attempt to disabuse the Agarwal theme of the industry withering under more than “100 per cent revenue sharing” burden, the ministry says “royalty and premium are part of cost of production and not something shared out of revenue/ profit.” An aggrieved New Delhi is left with no option but to demolish Agarwal specious argument that the winning “bid is based on how much revenue you will share with the government. Since auctions were introduced, the average for iron ore is 118 per cent.”

Among his litany of charges on the subject is the combination of “a limited number of blocks (iron ore)” on offer with steel companies in pursuit of raw material security offering competition to merchant miners at the auction has caused a “huge demand-supply mismatch.” This is sending bid prices to stratospheric levels. The ministry will not accept that the high bids are because not enough blocks come under the hammer. It says since auction became the sole form of mines allocation for transparency and fairness, 119 iron ore blocks have been auctioned of which 34 blocks have been operationalised. While 21 more blocks are made ready to become operational in near future, a number of blocks are at various stages of auction process with as many as other 60 blocks received by various state governments from the mines ministry for auction.

ALSO READ: Mining Electoral Bonds To Curry Favours

Dismissing any notions of “limited blocks are on offer,” the ministry claims that the revenue sharing formula has proved to be an incentive for iron ore bearing states to offer more and more blocks at auction. Interestingly such is the pull of the auction system that states such as Rajasthan, Maharashtra and Andhra Pradesh, which for very long have not figured in India’s iron ore map are now successfully auctioning newly discovered blocks. The ministry maintains that auction is the fairest way forward to grow production of iron ore, principally to meet the increasing demand of steel mills enhancing capacity.

Further, Agarwal has left the ministry miffed by his observation that high auction bids, resulting from competition, are the reason why “most of the blocks have not been operationalised. Operating companies are even considering returning some of the blocks because of unviability.” As one of the leading miners of iron ore, Agarwal, according to the government, should not be unaware that once a party has made the winning bid, it will be required to get a raft of statutory clearances, including relating to environment and forest. Moreover, land acquisition has its challenges. All this requires three to seven years, “depending on the level of exploration.” As auction process for most of the blocks was completed in the last three years, the ministry says another two to five years will be needed for their operationalisation.

For more details visit us: https://lokmarg.com/