RBI Keeps Repo Rate Unchanged At 4%

The Reserve Bank of India (RBI) on Thursday kept the key repo rate unchanged at 4 per cent in view of rising inflation and faint signs of economic growth amid the gradual lifting of coronavirus (COVID-19) countrywide lockdown.

The central bank’s monetary policy committee (MPC) began its three-day meeting on August 4 and maintained the stance as accommodative. It also kept the reverse repo rate unchanged at 3.35 per cent.

Repo is the rate at which RBI lends funds to commercial banks when needed. It is a tool that the central bank uses to control inflation.

While there are some signs of a pick up in activity due to the staggered easing of a lockdown, there is a large degree of uncertainty amid a surge in virus cases.

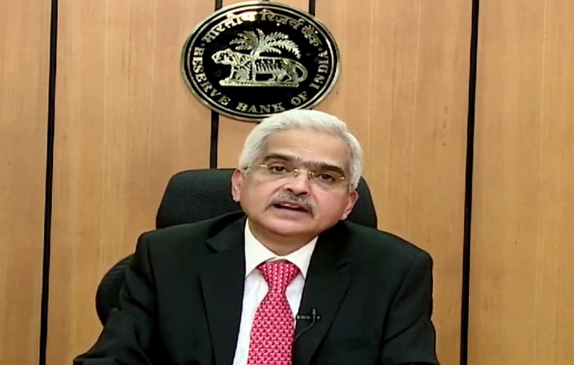

“The MPC voted unanimously to leave the policy repo rate unchanged at 4 per cent and continue with the accommodative stance of monetary policy as long as necessary to revive growth, mitigate the impact of COVID-19 while ensuring that inflation remains within the target going forward,” said RBI Governor Shaktikanta Das.

The headline inflation has breached the 6 per cent level, beyond the comfort level of the central bank. The RBI is tasked with keeping inflation at 4 per cent in the medium-term with a 2 percentage point leeway on either side.

Das said the headline inflation prints of April to May are obscured by a spike in food prices and cost-push pressures. Meanwhile, the cumulative reduction of 250 basis points is working its way through the economy, lowering interest rates in money, bond and credit markets, and narrowing down spreads.

“Given the uncertainty surrounding the inflation outlook and extremely weak state of the economy in the midst of an unprecedented shock from the ongoing pandemic, the MPC decided to keep the policy rate on hold, while remaining watchful for a durable reduction in inflation to use available space to support the revival of the economy,” he said.

On the economic growth, Das said India’s real gross domestic product (GDP) will contract in the first half of FY21 as well as full financial year. He did not put any number to it.

“We shall remain alert and watchful and collectively do whatever is necessary to revive the economy and preserve financial stability. Courage and conviction will conquer COVID-19.”

Significantly, the RBI also decided to allow lenders to provide a restructuring facility on some loans that were standard as on March 1. An expert committee will be set up under K V Kamath to work out thrash out modalities and look into resolution plans of eligible borrowers.

Among other key measures announced by the RBI, additional special liquidity facility of Rs 5,000 crore each will be provided to the National Bank for Agriculture and Rural Development (Nabard) and the National Housing Bank (NHB).

The RBI will also amend priority-sector lending guidelines to remove regional disparity. “An incentive framework is now being put in place for banks to address the regional disparities in the flow of priority sector credit,” said Das.

(ANI)