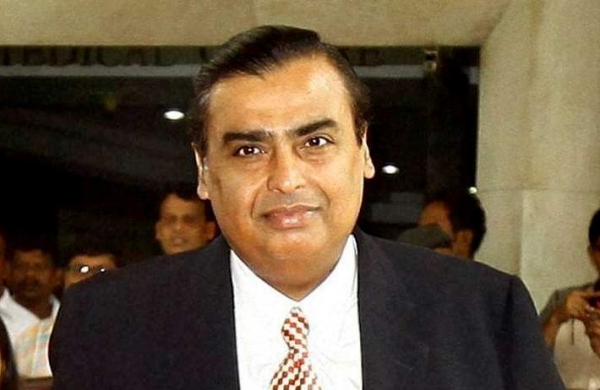

Reliance To Consider 1:1 Bonus In Its Sept 5th Board Meet: Mukesh

Reliance Industries announced that its Board of Directors will be meeting on September 5, 2024, to consider a 1:1 bonus issue for its equity shareholder, the company informed the exchange in a filing on Thursday.

This means that for every share an investor holds, they may receive an additional share if the proposal is approved.

“We wish to inform you that pursuant to Regulation 29 and other applicable provisions of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 (“Listing Regulations”), a meeting of the Board of Directors of the Company is scheduled to be held on Thursday, September 5, 2024 to consider and recommend to the shareholders for their approval, issue of bonus shares in the ratio of 1:1 to the Equity Shareholders of the Company by capitalization of reserves” said the company in the filing.

The company stated that the board will discuss and potentially recommend this bonus issue to the shareholders for their approval.

If the board approves this bonus issue, it will be funded by capitalizing the company’s reserves. A 1:1 bonus issue is often seen as a way to reward existing shareholders by increasing the number of shares they hold, effectively doubling their shares without any additional cost.

While this does not change the overall value of their investment, it can increase the liquidity of the shares in the market.

Bonus issues can also reflect a company’s confidence in its future prospects and a strong financial position, as it typically indicates that the company has sufficient reserves to distribute among shareholders.

Shareholders and investors will be closely watching the outcome of the meeting on September 5, as this decision could impact the stock’s performance and investor sentiment. If the bonus issue is approved, the shareholders will need to give their final nod in a subsequent general meeting.

Reliance Industries is a conglomerate with diversified interests in sectors such as petrochemicals, refining, oil, telecommunications, and retail. (ANI)

For more details visit us: https://lokmarg.com/

Tendulkar Family Stuns In Traditional Outfits At Arjun’s Pre-Wedding Celebs

India Provides Large No. Of Vehicles As Nepal Heads To Landmark Polls After Gen Z Protests

US Embassies Instruct Americans To Leave Middle East Immediately As Tensions Escalate