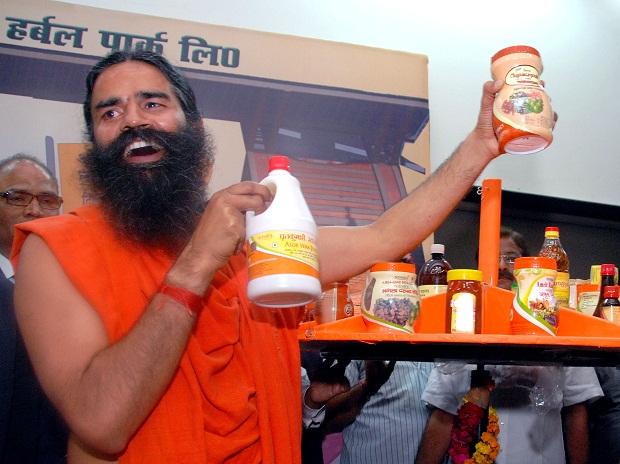

Hasn’t the magic of Baba Ramdev started

wearing thin? He is no longer featured prominently in newspapers and magazines

and TV channels, including the ones that a few years ago would go overboard in

allowing him to speak on subjects ranging from ayurveda to Hinduism to

exploitation of the countrymen by foreign companies working in his domain. Going

beyond the channels to the shock of many viewers allowed scantily clad Ramdev

to demonstrate yoga exercises on screen. But credit should be given where it is

due.

We have got many home-grown enterprises

engaged in making ayurvedic medicines and fast moving consumer goods (FMCG) and

running recuperation centres where treatment of physical and mental disorders

is based on traditional health care practices and spiritual therapies. Ramdev

and his Patanjali have made the already operating ayurvedic enterprises to sit

up and take notice.

Dabur, Himalaya, Vicco Laboratories and

Vopec Pharma have all based their medicines and FMCG products on ancient herbal

formulations refined by way of scientific research. All these companies not

only have a pan India presence but their products are finding growing

acceptance in the world market. Then there are more modest ayurvedic groups in

south India such as Coimbatore based Arya Vaidya Pharmacy which besides

producing medicines based entirely on in-house R&D are running ayurvedic

hospitals frequented by foreigners.

The point is promoters of none of these

companies has ever boasted like Ramdev that they are driven by the ambition to

have bigger business than the biggest FMCG group operating here – that is, Hindustan

Unilever Limited (HUL), a subsidiary of Anglo-Dutch foods, beverages and FMCG

giant Unilever.

When Ramdev made the statement in January

2018 that caused irritation and discomfort to foreign entities that besides HUL

include Nestle, Procter & Gamble and ITC in which British American Tobacco

has 29.58 per cent ownership. They started wondering wherefrom the public face

of upstart Patanjali was drawing spunk to take on industry heavyweights. Ramdev

didn’t stop at that. He was also opposed to foreign direct investment (FDI) in

retail. Many believe what he said was actually espoused by many in Hindu

nationalist Rashtriya Swayamsevak Sangh (RSS). But the man who has

unquestionable yoga skills and successfully promoted the Hindu health exercise

in and outside the country has mellowed as the foreign owned FMCG groups have

decided to fight it out with Patanjali on its much vaunted ayurvedic turf.

In a December 2016 report Axis Capital said

Patanjali was targeting a turnover of Rs40,000 crore by 2018-19. That is long

past and we have it from business intelligence platform Tofler that Patanjali

Ayurved could manage to lift revenue to 9,088 crore in 2019-20 from 8,542 crore

in 2018-19 and net profit by 21.56 per cent to Rs424.72 crore. All his past blusters

that in a few years Patanjali would leave HUL with an Indian heritage of more

than 80 years well behind have come to nothing. HUL, which claims that more

than nine out of ten Indian households use one or more of its brands spanning

home care, beauty and personal products and food and refreshment products,

notched up a net revenue of Rs38,785 crore and a net profit of R6,743 crore in

2019-20.

While there was no reason for HUL and

others in the same group to be unnerved by Ramdev’s threat, which in any case

was bizarre, they didn’t miss the point that the arrival of Patanjali and its

fast growth for about a decade awakened the latent demand for ayurvedic

products. According to the US based Research & Markets, the market for

ayurvedic products in India will be growing at a compound annual growth rate of

16.06 per cent to expand the market from Rs30,000 crore in 2018 to Rs71,087 crore

in 2024. Aided by various government and privately funded promotion campaign,

around 80 per cent of Indian households are now using ayurvedic products and

ayurveda based holistic healing systems against 67 per cent in 2015.

What is clearly discernible is that on

wellness ground, a growing number of people are giving up using chemical-based

personal care products from soap to shampoo in favour of natural ones using

herbal ingredients. In the present Covid-19 times, the vendors in fact have a

challenge to meet the growing demand for organic food and beverages that have

herbal ingredients.

Having noticed the demand growth potential

of ayurvedic products in the country and abroad – their exports amounted to

nearly $450 million in 2018-19 – Indian outfits of multinational FMCG groups

expectedly created their own product lines, either organically or by way of

takeover of modest size enterprises looking for bailouts. HUL launched Ayush in

2001. But success at that point eluded HUL since the ayurvedic market was small

and the company was not aggressive enough in promoting its ayurvedic products.

In more recent times as ayurveda was catching popular attention and Patanjali was

gung-ho about what it was set out to do, albeit with covert government support,

HUL acquired in December 2015 the Kerala based Moson group’s ayurvedic unit

Indulekha for Rs330 crore. At more or less the same time, HUL launched the Ayus

range of products at highly competitive prices to remain relevant in a market

where Patanjali was seen to be indulging in predatory pricing.

Earlier when in 2012 Nestle commissioned

its R&D centre at Manesar in Haryana, a company official said the outfit

would make use of traditional Indian ayurvedic knowhow in some product

development. This is exactly on the lines of Nestle delving into Chinese

knowledge of medicine in its operations there. Incidentally, the resounding

success of Nestle, the world’s largest food company is underlined by its having

over 30 R&D centres in different countries to benefit from local knowledge

and finally make food that will appeal to native palate.

The Indian oral care market has always been

dominated Colgate Palmolive India. At its peak but ahead of Patanjali forayed

in the oral care space with Dant Kanti brand and a few others, the local arm of

the US consumer goods company had a market share of 58 per cent. But as this

has now been whittled down to 52 per cent, the other producers to reckon with

here such as HUL, Dabur and Vicco also bore the brunt due to the rise of

Patanjali. The only option available to Colgate to staunch any further loss of

market share was to take a piggyback ride on ayurvedic dental products. Colgate’s

Swarna Vedshakti, Cibaca Vedshakti and its charcoal clean toothpaste continue

to gain market traction, showing which way Indian preference is growing.

Prime minister Narendra Modi does not make

himself available unless the occasion is exceptionally important. His

inaugurating the Patanjali Research Institute at Hardwar built at a cost of

Rs200 crore in May 2017 gives an idea of Ramdev’s access to the corridors of

power. But on quite a few occasions the yoga guru was caught on the wrong foot.

When pharmaceutical giants such as Pfizer, Moderna, Astra Zeneca and Sanofi are

engaged in doing intensive research and investing unbelievable amounts to

develop vaccines that will prove effective in combating the Covid virus,

Patanjali had the gall to declare at the height of the Pandemic in India that it

had found the solution to the global health crisis in its Coronil and Swasuri

medicines, made from a mixture of ashwagandha, tulsi and giloy (heart-leaved

moonseed).

However close Ramdev may be to the ruling

coalition in New Delhi, this proved to be a shocker to the government. Earlier

too, his claim that Patanjali’s Divya Putrajeevak Beej guaranteeing the birth

of a male child was laughed out of court. Like illusionist Harry Houdini,

Ramdev once said cancer patients could be cured by practising yoga. This

alarmed oncologists, for some innocents might follow his advice instead of

seeking right medical treatment.