People heading a government, especially if the country happens to be the United States of America or China or India, are expected to be the master of statecraft. That not only is good for its own people, but the global community also stands to benefit in many ways from such conduct. Unfortunately, the sledge hammer blows that Donald Trump, on his ascending the office of the President is administering on many fronts, including tariffs, immigration and universities of the stature of Harvard and Columbia on specious grounds and harassment of those protesting against the sufferings of Palestinians going to the extent of deportation are unnerving for the rest of the world. But in his first term as President and also during his last election campaign, Trump did drop many hints of the many unconventional moves he would be making. This article discusses the likely fallout of his pursuit of reciprocal tariffs, amounting to protection, militating against the basic principles of capitalism.

Leading economist and professor emeritus at Jawaharlal Nehru University Prabhat Patnaik has likened the weaponization of tariffs by the US President Donald Trump to beggar-thy-neighbour policy for naked aggrandisement of his country’s business and commerce. Rarely used by major countries, the policy is tantamount to building protectionist walls mainly through unreasonably high tariffs (remember India is still to live down the image of a ‘tariff king’ despite the process of lowering of import duties began following pathbreaking 1991 reforms), import quotas and subsidisation of exports. Giving protection to domestic industry overtly and covertly as China is widely accused of doing militates against the principles of free trade. It also is an antithesis of what all the World Trade Organisation (WTO) stands for and the spirit of trade negotiations among countries for improved access to each other’s market.

The US has for long been the citadel of capitalism. It will be recalled that the US was among the key drivers that built WTO in 1995 as successor to the General Agreement on Tariffs and Trade (GATT). The twin objectives were to make global trade liberalisation a continuous process and create a robust institutional framework for resolution of trade disputes. Whatever good work WTO may have done in the last 30 years and that definitely includes anti-dumping agreement, which bars member countries to introduce anti-dumping measures arbitrarily is now being undermined by President Trump’s tariff threat and demonisation of the institution by the political right in the US. The anti-WTO tone, it will be recalled was set in Trump’s first term in presidential office. Launching a campaign against the trade organisation, Trump then described the agreement that established WTO as the “single worst trade deal ever made.” He thought WTO proved to be a “disaster for America” since millions of jobs in the US were lost because of that institution. Idee fixe is what Trump is all about. Otherwise, why should he remain so obsessed with tariff-based trade policy even while economists in his country and outside have railed against it. The irony is, the long-time champion of open markets America under President Trump is raising the spectre of protectionism.

Trump perhaps does not subscribe to the theory of comparative advantage first propounded by economist David Ricardo. Simply put, it says let each country stay focussed on products it can make at relatively lower cost and more efficiently than others. That will create condition for countries engaged in trading with each other to become more prosperous. But it was only after the second World War that governments, including the US thought of institutionalising a liberal international trading system with fixed rules. So, we had GATT and then WTO.

The problem with Trump is that he is the President of the world’s largest economy whose imports of goods exceed that of any other country. The rest of the world is left angry and disappointed by President Trump’s rejection of WTO principles of non-discrimination and reciprocity and all his blustering talk of reciprocal tariffs at different levels for different countries. Reciprocal tariffs though have been kept in suspension till July 9, allowing the interlude for nations to be engaged in trade negotiations with the US for tariffs to be settled at acceptable levels. In the meantime, the UK and China have been able to sign tariff deals with the US. However, there are some sticking points holding up a deal with the European Union (EU). Our commerce minister Piyus Goyal remains optimistic about India-US trade deal before reciprocal tariffs set in on July 9.

A US President has the advantage of being counselled on the economy, national security, foreign policy and everything else by the best brains. But the problem arises, when the chief executive of the federal government not only comes to the office with preconceived ideas and remains adamant to see those implemented. Reciprocal tariffs, high barriers to imports all speak of protecting domestic industries, whose competitiveness vis a vis their counterparts in other countries has been blunted for a variety of reasons.

Mainly because of relatively high labour cost, failure to keep in step with technology breakthroughs whose application in the meantime by offshore competitors has resulted in their improved productivity and lowering of cost and promoter apathy to make fresh investment, capacity of industries in the US rust belt, principally steel and aluminium has shrunk over the years.

Naturally, as the US started making less and less steel and aluminium, the two industries grew in stature in China and now they are nursing surplus capacity. The Asian giant producing a lot more of the two metals than can be used domestically is accused of dumping, that is, selling at a discount of production cost and also having the benefit of hidden government subsidy, the products in a number of countries. India is a victim of Chinese aggressive exports like the EU.

At the same time, Chinese steel and aluminium exports to the US last year were not of a volume to cause any genuine concern. In any case, Trump attempt to resurrect American manufacturing per se and metal industries in particular by hiking tariffs is seen as a flawed attempt by Nobel laureate Joseph Stiglitz. First, the ones thinking of relocating factories in the US will not find it at all easy to overcome logistical challenges and supply chain hindrances. Debunking the Trump vision of a 1950s style economic revival, Stiglitz says whatever be the new investment in industrial enterprises, job creation will be ‘negligible,’ thanks to dominance of robots in manufacturing.

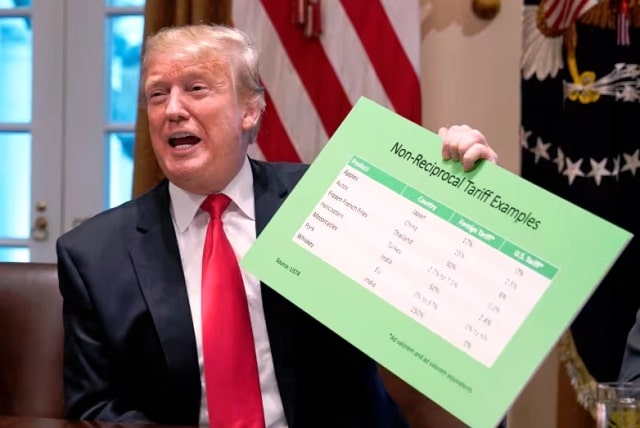

Yet another Nobel laureate Geoffrey Hinton has come down hard on Trump administration for its plan to raise funds by way of raising tariffs and cutting government spending to be able to benefit the rich through a $4 trillion tax cut. Describing this kind of policy approach as ‘disgusting,’ Hinton says it amounts to giving the rich tax breaks by penalising the ordinary consumers who will be required to pay more for imported as well as domestically made products. President Trump’s attempt to sell the idea of highly enhanced tariff on the premise that countries such as China and India and also the EU enjoy considerable trade surpluses with the US falls flat since he evades mentioning the moolah that comes to America from the export of services.

Take the case of India which had a trade surplus of $44.4 billion with the US in 2024-25. But when account is taken of American services, including education, software and digital, financial activities and arms trade, the US rakes in a surplus of up to $40 billion in its total trade with India. Similarly, if services are taken into account, then the US-EU trade is balanced. Even while a number of countries are now engaged in trade negotiations with the US, the world is resigned to the fact that Washington will finally have a protection level much higher than in recent memory. Besides hurting American consumers, high tariff threat is creating uncertainty for the global economy as also putting a hold on many investment and development projects.