The Reserve Bank of India (RBI) has projected India’s real GDP growth to be at 6.4 per cent for the next financial year 2023-24.

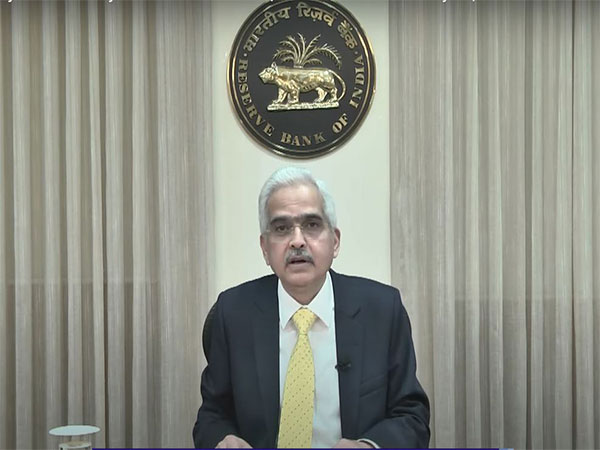

“Broad-based credit growth, improving capacity utilisation, government’s thrust on capital spending and infrastructure should bolster investment activity,” RBI governor Shaktikanta Das said on Wednesday while announcing the monetary policy meeting outcome.

“According to our surveys, manufacturing, services and infrastructure sector firms are optimistic about the business outlook. On the other hand, protracted geopolitical tensions, tightening global financial conditions and slowing external demand may continue as downside risks to domestic output.”

The GDP projections for Q1, Q2, Q3, and Q4 2023-24 are estimated at 7.8 per cent, 6.2 per cent, 6.0 per cent, and 5.8 per cent, respectively, with risks, evenly balanced.

Meanwhile, the Monetary Policy Committee (MPC) of the RBI decided to raise the repo rate, at which the RBI lends money to all commercial banks, by 25 basis points to 6.5 per cent.

Four out of six members of MPC have decided to go ahead with this hike in the repo rate, RBI Governor Shaktikanta Das said.

The Shaktikanta Das-headed Monetary Policy Committee (MPC) started its three-day meeting on February 6 amid the rate hiking spree that started in May last year to check inflation.

India’s retail inflation during the month of December was at 5.72 per cent, versus 5.88 per cent in November and 6.77 per cent during October.

India’s retail inflation was above RBI’s six per cent target for three consecutive quarters and had managed to fall back to the RBI’s comfort zone in November 2022.

Since May last year, the RBI has increased the short-term lending rate (repo rate) by 250 basis points, including today’s, to contain inflation, driven mainly by external factors, especially global supply chain disruptions following the Russia-Ukraine war outbreak. (ANI)

Read More: http://13.232.95.176/