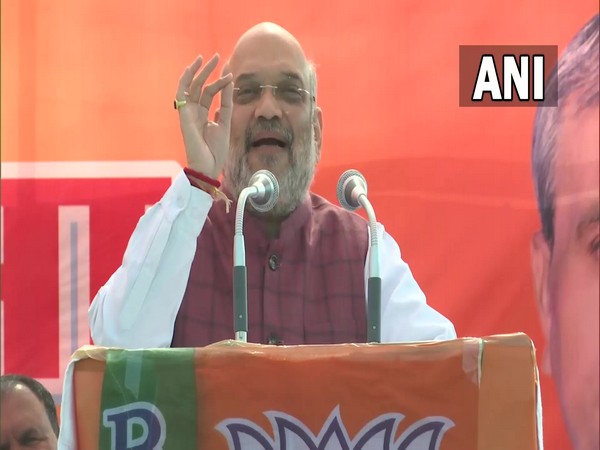

Highlighting the country’s growth stride, Union Home Minister Amit Shah on Saturday said that India, which was ranked 11th on the list of the world largest economies in 2014, has today overtaken the UK to occupy the 5th position.

Addressing a public rally here, Shah said, “This Amrit Kaal is the time to set goals for the people of the country. I want to tell all the youth of the country that you must decide a goal of your life for the country and definitely take a resolution.”

“In 2014, our country stood at 11th position in world economy list. Today we have overtaken the UK to hold the 5th position. We have conveyed it to the world that in 75 years, we have moved ahead of you and made our independence meaningful,” added the Home Minister.

Pertinent to mention, India has overtaken Britain to become the world’s fifth largest economy and as per International Monetary Fund (IMF) projections, only USA, China, Japan, and Germany are now ahead of India in terms of the volume of the national economy.

The lead was attained during the last three months of 2021 and extended in the first quarter of 2022. India has jumped six positions over the last decade. Only a decade ago, it was in the eleventh position while the UK occupied the fifth rank. It has also extended its share in the global GDP by nearly one percentage point since 2014 when it was the 10th largest economy in the world. India’s share in the global GDP is now 3.5 pc as against 2.6 pc in 2014.

Shah is on a two-day visit to Bihar. Earlier today, he inaugurated five Border Out Posts of Sashastra Seema Bal (SSB) in Kishanganj.

Lauding the role of the SSB in the battle against Naxalism, the Union Home Minister said owing to their “tough fight”, Naxalism has been finished in Bihar and Jharkhand regions.

“SSB jawans have fought a tough fight against Naxalism rampant in the northeast. As a result, Naxalism is on the brink of ending in Bihar and Jharkhand regions, we can even say it is finished here,” Shah said while speaking on the occasion.

Acknowledging their duty, the Home Minister said that the SSB has the toughest duty to perform because of the open border with Nepal and Bhutan.

“Sitting in Delhi, one thinks you have the easiest duty as we’ve friendly relations with both nations (Nepal and Bhutan). But when one comes to the border, we realise that you have the toughest duty as it’s an open border,” he said.

“The responsibility increases if it’s an open border. However friendly may the relations be, even if the neighbouring nations have no ill intentions, there are a few elements in society who use open borders for unauthorised earning – be it smuggling, animal smuggling or infiltration,” the Minister added.

Earlier today, Shah offered prayers at Budhi Kali Mata Temple at Subhashpally Chowk of Kishanganj.

Meanwhile, speaking on Nitish Kumar, Shah on Friday addressed the ‘Jan Bhavna Mahasabha’ rally and said that the people of the state will “wipe out the Lalu-Nitish duo” in the 2024 general elections and the party will come to power in the state in 2025.

Addressing the ‘Jana Bhavna Mahasabha’ in Bihar’s Purnea, Shah said, “In 2014, you (Bihar CM Nitish Kumar) only had 2 LS seats, ‘naa ghar ke rahe the, naa ghaat ke’. Let the 2024 LS elections come, the Bihar public will wipe out the Lalu-Nitish duo. We’re, with a full majority, going to come to power here in 2025 polls”.

Shah further said that Nitish Kumar does not favour any political ideology, and can join hands with any party to stay in power.

“Nitish Kumar is not in favour of any political ideology. Nitish ji can leave socialism and go with Lalu ji also, can do casteist politics. Nitish ji can leave socialism and sit with the Left, Congress. He may also leave RJD and join BJP. Nitish has only one policy – my chair should remain intact,” he said. The Home Minister said that danger of “‘Jungle-raj’ is looming over Bihar”. (ANI)

Read More:http://13.232.95.176/