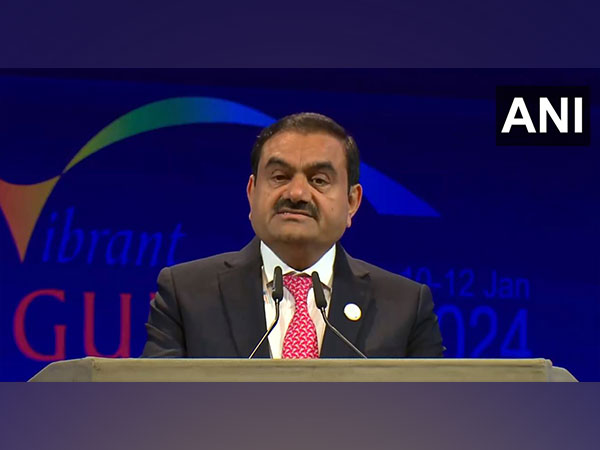

Early this year Hindenburg Research, a New York financial firm, accused the Adani Group, India’s diversified industrial conglomerate (total revenues: $33 billion or Rs 2.625 lakh crore) of pulling off the biggest scam in corporate history by manipulating its own stock through offshore entities and, thereby, boosting the group’s value, which had reached a peak of $288 billion last year.

At that time, the Adani Group, which has interests in areas spanning sectors such as energy, resources, logistics, agriculture, defence and aerospace, had refuted the allegations calling them a calculated attack on India, and on the “the independence, integrity and quality of Indian institutions”. The group is headed by Gautam Adani, 61, who is also close to the Indian Prime Minister Narendra Modi. Their relationship dates back to when Modi was the chief minister of Gujarat, Adani’s home state, and Adani supported Modi’s political ambitions and economic vision. Since Modi became the prime minister, Adani’s net worth has increased by almost 250%, and some critics have accused him of benefiting from Modi’s policies and influence, and have raised concerns about the impact of their ties on India’s democracy and media freedom.

Following the Hindenburg accusations the Adani Group’s stock prices tumbled, eroding its valuation and dislodging Adani from a prime spot on the global richest list. However, there was no concerted investigation into the allegations that Hindenburg made.

Now, a fresh wave of controversy has hit Adani. New documents obtained by the Organised Crime and Corruption Reporting Project (OCCRP), a global network of investigative journalists with staff on six continents, for the first time have revealed details of the complex offshore operations based in Mauritius and apparently controlled by Adani’s associates and relatives. These operations were allegedly used to manipulate the share prices of the group’s companies between 2013 and 2018.

The new documents further establish that Gautam Adani’s brother, Vinod, has had links with the offshore entities that were used in the share manipulation operations. The investigations by the OCCRP have also found that the Indian stock market watchdog Securities & Exchange Board of India (SEBI) was handed evidence of the suspicious share trades as early as in 2014 but its efforts to follow up on it died down shortly after the Modi regime came to power in the same year.

Following the OCCRP revelations, many in India, including Opposition leaders, activists, and others, have demanded a probe into the group’s operations, particularly those linked to the alleged share manipulation. It is time now for SEBI, which is ostensibly an independent body, to conduct a full-scale investigation into the issue. Will that happen?

What China’s Slowdown Means for India

China’s $18-trillion economy is the second largest in the world, and its growth has been slowing down in recent months due to various factors, such as the Covid-19 pandemic, the power shortage, the real estate crisis, and the regulatory crackdown on some sectors. According to the latest data, China’s GDP growth this year is expected to be 4.6%, lower than the average of 9% that it has clocked annually since its economy opened up in 1978. Some analysts have warned that China’s economic troubles could have negative impacts on the global economy, especially on the commodity exporters, the trade partners, and the financial markets that are exposed to China.

One of the countries that could be affected by China’s slowdown is India, which has a complex and competitive relationship with its northern neighbour. India’s bilateral trade with China has grown nearly 50% over the past two years. China is India’s largest trading partner and a major source of imports for various sectors, such as electronics, pharmaceuticals, chemicals, and machinery. A slowdown in China could reduce the demand for some of India’s exports, such as iron ore, cotton, and seafood. It could also disrupt the supply chains and increase the costs of some inputs for India’s industries.

On the flipside, though, China’s slowdown could also present some opportunities for India to attract more foreign investment, diversify its trade relations, and enhance its competitiveness in some sectors.

For example, India could benefit from the global shift of manufacturing away from China due to rising costs and geopolitical risks. India could also leverage its domestic market, its demographic dividend, its digital innovation, and its strategic partnerships to boost its economic growth and resilience.

What is more, India could use the window of opportunity to resolve some of its structural challenges, such as improving its infrastructure, reforming its labour laws, enhancing its ease of doing business, and strengthening its financial sector.

What is Chandrayaan-3 Doing After it Landed on the Moon?

After Chandrayaan-3’s lander, named Vikram, touched down on the lunar soil near the south pole of the moon, it is its rover, named Pragyaan, which has swung into action, taking its first steps on the moon.

The Indian Space Research Organisation (ISRO) has been periodically updating the world on what the rover has been up to and its findings. Here are some of the highlights:

First, it has found many chemicals in the lunar soil. These include, notably sulphur and oxygen. Other chemicals that have been found include aluminium, calcium, iron, chromium, titanium, manganese, silicon and oxygen.

The Vikram rover has also negotiated several craters, including ones that measure a diameter of over four metres on the surface of the moon. These give an idea of the lay of the land on the moon.

The other major finding by Vikram’s roving on the surface is an insight into the temperatures on the moon. According to preliminary data, the temperatures vary widely. While the temperature on the surface of the moon was expected to be in the range of 20-30 Celsius, Vikram has found temperatures on the surface to be 60 C or higher, while temperatures just three inches below the surface apparently drop to -10 C.

This confirms the earlier findings that the temperature ranges on the moon are extreme and some crates that lie permanently in the shadows of the south pole are extremely cold. One of the main objectives of Chandrayaan-3, besides getting an idea of the elements that are found on the moon, is to find whether there is also water there.

After the Moon, it’s the Sun…

On Saturday September 2, Aditya-L1, India’s first dedicated space mission to study the sun, was launched by ISRO from the Satish Dhawan Space Centre at Sriharikota in Andhra Pradesh. The mission consists of a satellite that carries seven scientific instruments to observe various aspects of the sun, such as its corona, photosphere, chromosphere, and solar wind. The satellite is placed in a halo orbit around the L1 point, which is a gravitationally stable spot about 1.5 million kilometres from Earth in the direction of the sun. The mission is expected to provide valuable data and insights into the solar activities and their effects on space weather and climate.

India’s solar mission has two aspects: one is a national policy to promote solar power, and the other is a space mission to study the sun.

The National Solar Mission is an initiative of the Indian government to promote solar power. The mission is one of the several policies of the National Action Plan on Climate Change and it aims to achieve 100 GW of solar power capacity by 2022, and to reduce the cost of solar power generation in India. The mission also supports various schemes and programs, such as rooftop solar, grid-connected solar, off-grid solar, and solar parks.

The Controversy at Ashoka University

The recent controversy involving Ashoka University, a leading private university, began when one of its faculty members, Sabyasachi Das, resigned after facing backlash for his research paper that suggested possible vote manipulation by the ruling Bharatiya Janata Party (BJP) in the 2019 general elections. The paper, titled Democratic Backsliding in the World’s Largest Democracy, presents evidence that indicates voter suppression to favour the BJP, especially against the Muslim minority group.

The university has since distanced itself from the paper, saying it has “not yet completed a critical review process” and instituted an inquiry committee to examine its academic merits. Das resigned from his post, saying he felt “uncomfortable” and “unwelcome” at the university. His resignation sparked protests by students and teachers at Ashoka, who accused the university of stifling academic freedom and bowing to political pressure

This is not the first time that Ashoka University faced criticism for compromising its academic independence. In March 2021, two prominent professors, Pratap Bhanu Mehta and Arvind Subramanian, also resigned from the university, citing concerns over the lack of freedom and autonomy. Mehta, a political scientist and public intellectual, had been vocal in his criticism of the Modi government and its policies. He wrote in his resignation letter that his association with the university was a “political liability” for its founders and donors.

Subramanian, a former chief economic advisor to the government, resigned in solidarity with Mehta, calling his exit “ominously disturbing” for academic freedom.

These incidents have raised questions about the role and responsibility of private universities in India, especially in the context of increasing state interference and intolerance towards dissenting voices in academia.

Some critics have argued that private universities are more vulnerable to political and financial pressures than public ones, and that they lack transparency and accountability in their governance and decision-making processes. Others have defended Ashoka University as an example of excellence and innovation in higher education, and have urged its founders and authorities to uphold its vision and values of liberal arts and sciences.

Ashoka University, located in Sonipat, Haryana, India, focuses on liberal education in humanities, social sciences, and natural sciences. It was set up in 2014 by a group of philanthropists and entrepreneurs who wanted to create a world-class institution for higher learning.