People buy life insurance policies on the basis of trust that insurance companies would make investment of premium money based on knowledge and prudence to secure the future of insured and make every attempt to give them good returns on investment. The business is expected to be conducted on the “principle of utmost good faith.” The country’s largest life insurer Life Insurance Corporation, in which the government owns 96.5 per cent after it sold 3.5 per cent ownership through initial public offering at a price of Rs949 a share of Rs10 face value, is found to have painted itself into a corner over its bewilderingly large investment in Adani Group companies, more by way of share purchases than sanction of debts.

Since the publication of Hindenburg report on January 24 levelling accusations of “brazen stock manipulation and an accounting fraud scheme over the course of decades,” shares of all Adani Group listed companies have come in for free fall. LIC shares too have suffered a collateral damage with the price hitting 52-week low. This cannot be otherwise because LIC has humongous investments in the beleaguered group.

Between the revelations by the US short-seller Hindenburg, claimed to be based on a two-year investigation, the Adani group’s market capitalisation has shrunk by Rs12.06 lakh crore, or 63 per cent. If one goes by Hindenburg report, which is strongly denounced by Adanis as anti-Indian, the share rout is not complete yet. (But should a private group invoke nationalism as defence when it comes under a cloud?) The report ominously says: “Even if you ignore the findings of our investigation and take the financials of Adani Group at face value, its seven key listed companies have 85 per cent downside purely on a fundamental basis owing to sky-high valuations.” At the time of Hindenburg report release, the Group, which saw meteoric price rises on the stock market, had a market capitalisation of Rs19.12 lakh crore. This, however, was down from the high of Rs22.93 lakh crore on September 20, 2022. Almost like a seer’s prediction, some of the seven Adani stocks have lost value teasingly close to 85 per cent, as Hindenburg report anticipated.

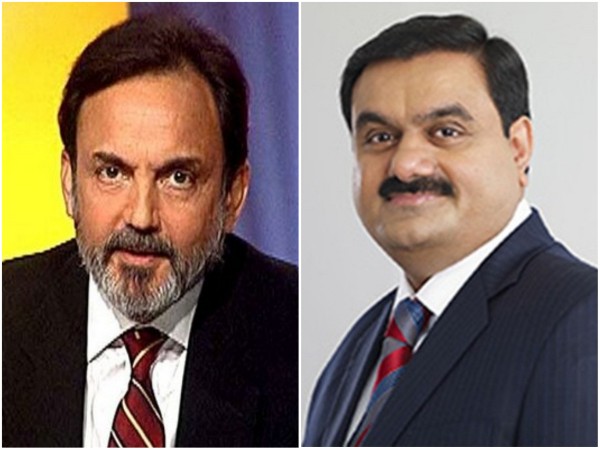

Take Adani Enterprises, the Group’s holding company. Stung by collapse of share prices, it was compelled to call off the follow on public offer (FOPO) set at between Rs3,112 and Rs3,276 (full subscription had to be ensured by way of pulling strings with investors in the Gulf and some friendly groups here) and return money to subscribers. What could Gautam Adani have done but return the money his flagship enterprise secured in the course of FOPO with open market price seeking lower and lower price at every trading session. As a result of the stock market rout, Gautam who rapidly rose to become the world’s third richest man with a net worth of $116 billion (Bloomberg Billionaires Index as on December 28, 2022) and India’s and also Asia’s richest. But with his net worth experiencing a free fall every trading day caught in a short selling blizzard, Gautam , according to Forbes, now with wealth of $33.4 billion is 38 in global ranking of the richest.

But whatever the popular perception of Gautam following the Hindenburg accusations, to be fair to the man, he is never boastful of his and his family’s wealth. In an interview following his ascendance to the world’s third richest slot with India Today Group, he said: “These rankings and numbers do not matter to me. They are only media hype. I am a first generation entrepreneur who had to build everything from scratch. I get my thrill from handling challenges. The bigger they are, the happier I am.” He claims to find joy in meeting challenges and finding solutions. If that be so, proving Hindenburg wrong that his “amassing a net worth of roughly $120 million in the past three years largely through “brazen stock manipulation and accounting fraud” is the challenge he surely never thought would come his way. The degree of his brazenness is shown in spikes of shares of Adani Group’s “seven listed companies” by an “average of 819 per cent… in the past three years.”

Such unimaginable building of wealth in a short period, indefensible support of government institutions such as LIC and State Bank and ease in acquiring expensive assets like the Indian cement business of Holcim, according to many observers, would not have been possible without the blessings of the powers that be. There has not been a singular intervention by regulators such as Securities and Exchange of Board of India (SEBI) and Reserve Bank of India (RBI) to rein in the Group or talk of any inquiry when the Group fortunes were ascending at stratospheric rates. Going by the Hindenburg report, the Group’s meteoric rise was aided in no small way by: (i) Adani companies piling up substantial debts by pledging shares whose prices were inflated through market manipulation. As a result, “five of the seven listed companies are indicating near-term liquidity pressure.” (ii) Its research has allegedly established that Gautam’s elder brother Vinod or his close associates “manage a vast labyrinth of offshore shell companies.” The US short-seller claims to have found 38 Mauritius shell companies and also similar such entities in Cyprus, the UAE, Singapore and several Caribbean Islands under Vinod’s charge.

Financial and reputational scars that the report left on Adani Group and the family led them to dismiss it as “maliciously mischievous.” They don’t think it is based on “research” at all. The group legal head Jatin Jalundhwala said: “The unsubstantiated contents are designed to have a deleterious effect on the share values of Adani Group companies as Hindenburg, by their own admission, is positioned to benefit from a slide in Adani shares.” Such expected blasters apart, the Adanis are in the process of evaluating provisions of Indian and US laws for “remedial and punitive action against Hindenburg.” Hindenburg, it will appear, will welcome a legal battle in a court in the US “where we operate. We have a long list of documents we would demand in a legal discovery process.”

ALSO READ: The Adani Ascendency Phenomenon

One will not be surprised if instead of going to the court, the Adani Group will stay focussed in servicing debts, make payment for loans as they mature, run businesses from mining to ports to power efficiently removing opaqueness that invites criticism. Hindenburg report makes the allegation that “the Group’s very top ranks and eight of 22 key leaders are Adani family members, a dynamic that places control of the Group’s financials and key decisions in the hands of a few. A former executive described the Adani Group as a family business.” There is nothing wrong in competent family members holding important offices in businesses. But the important requirement is they at all cost avoid doing the kind of shenanigans mentioned in Hindenburg report.

It will be a long time before the bewildering Adani drama gets unfolded. This is despite finance minister Nirmala Sitharaman saying “our regulators are very stringent about governance practices and have kept our markets in prime condition.” In an attempt to reassure the public she also said the exposure of LIC and SBI to Adani Group was “within permissible limit.” Her statement ten days after the publication of the Hindenburg report was intended to restore confidence among investors. To her mortification, however, along with the continued Adani rout, the broad market too is experiencing value erosion almost on a daily basis. Intriguingly while mutual funds in general have stayed clear of Adani shares, LIC is found generous with public money to invest heavily in Adani shares. The government owned life insurer owns between 1.28 per cent and 9.14 per cent of issued capital of seven listed Adani companies. People have the right to know on what consideration LIC investment experts opened the purse, which they hold in trust of millions of insured, to acquire Adani shares.

The alleged omissions of Adani Group have provided a handle to the Opposition, particularly the Congress and its uncrowned leader Rahul Gandhi with the stick to berate the government, both within and outside Parliament. Gandhi vitriol is mainly targeted at prime minister Narendra Modi. The Gandhi proposition is the stunning wealth build up of Gautam Adani through his string of companies in such a short period is because of his proximity to Modi and government investigative agencies not bothering him. To Gandhi’s mortification, however, the Lok Sabha speaker Om Birla expunged much of what he said in the Lok Sabha on the subject as he rejected the Opposition demand for investigation on Adani Group by a joint parliamentary committee (JPC).

The immediate fallout of Hindenburg report and the stock market rout of Adani shares that followed is the Group decision to tread carefully with expansion. The decision not to bid for government ownership of Power Trading Corporation has already been made. Will the Group still be a contender for PSU (public sector undertaking) NMDC Steel, which the government has decided to exit? Hasn’t the Adani plan to build a 4 million tonne alumina refinery as well as an iron ore project involving an investment close to Rs60,000 crore in Odisha announced in August 2022 with much fanfare too become uncertain? Unlike Congress, Trinamool Congress has been circumspect in criticising the Adani Group, which last year announced the plan to construct a deep sea port at Tajpur in East Midnapur of West Bengal. Speculation is rife if investment starved Bengal will get to see work on port construction starting anytime soon.

When Gautam Adani remains the target of vitriolic attack from so many quarters, the country’s senior most economics editor Swaminathan S Anklesaria Aiyar has made some interesting contrarian observations in an article in The Economic Times. He writes: “Adani critics say he shot to riches not through skills but manipulation and minting money in cosy monopolies. I disagree. Going from humble origins to global No. 3 in two decades is impossible without exceptional business skills.” Aiyar thought it would be appropriate to make a mention of Dhirubhai Ambani to drive home the point that Adani is not guilty of playing tricks that the country didn’t experience before. It goes like this: “Once, Dhirubhai Ambani was also accused of political manipulation and boondoggles. He responded, ‘What have I done that every other businessman has not?’… Other businessmen, many with formidable historical advantages, had also wooed politicians and fiddled books, For a newcomer like Dhirubhai to beat the old giants at their own game signified immense talent. Something similar can be said of Adani.”

Finally, Aiyar says, “The Hindenburg report may be the best thing that ever happened to Adani. It will slow his speed of expansion… and force his financiers to be diligent and cautious in future. This could impose highly desirable financial discipline on Adani, to his own benefit.” He concludes by saying: “One day I might actually buy Adani shares.” Aiyar thereby is confirming that Adani has the acuity to overcome his current problems and steady the Group. Aiyar is not alone to have come out with support for Gautam. KP Singh, chairman of DLF, says: “Good side I find with Adani is all his companies are operation-wise profitable… Adani will come back again. It is not end of story.” Aiyar has a few others from business and industry keeping him company.

Read More:http://13.232.95.176/