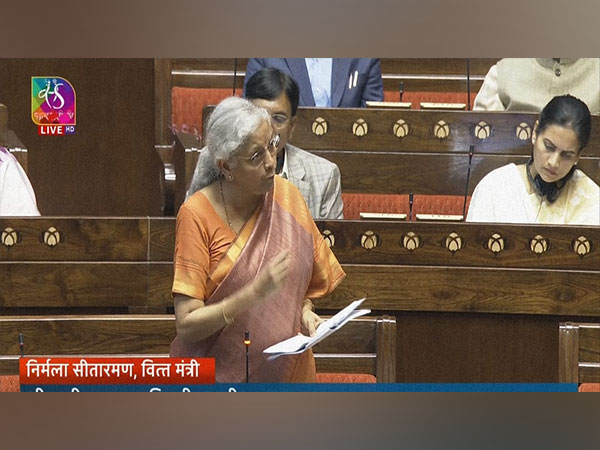

Given even half a chance, politicians of all hues will indulge in breast beating. The country was witness to this once again when in the course of 2022-23 budget presentation finance minister Nirmala Sitharaman claimed India’s expected GDP (gross domestic product) growth of 9.2 per cent during 2021-22 would be highest among all large economies. This “sharp recovery and rebound of the economy is reflective of our country’s strong resilience.” In the meantime, however, the Manila headquartered Asian Development Bank in its recently released ‘Asian Development Outlook 2022’ report says India’s GDP last year ‘likely’ grew 8.9 per cent. Mark the word likely in ADB’s calculation.

Whatever 2021-22 growth is finally recorded, Sitharaman could always say in her defence that she presented the budget two months before the closure of financial year and she was only referring to advance estimates. A Trinamool Congress MP was certainly not fair in saying the FM was speaking with ‘fork tongued’ in making such a tall claim for the economy under her charge. No doubt she was boastful, for last year’s growth should ideally be seen against the background of GDP slipping 6.6 per cent in 2020-21. And the 2019-20 GDP growth was a dispiriting 3.7 per cent, very closely approximating the Hindu rate of growth coined by economist Raj Krishna.

The whole of 2019-20 when the bite of Covid-19 pandemic manifested in a series of deadly infections, lockdowns, supply chain disruptions and large-scale migration of labourers to their villages and small towns suffering in the process unbearable hardships was a washout for all economies and India was not an exception. Even while fears of new Covid waves remained throughout the year that closed in March 2021, any relief on that count was negated by high rates of inflation.

Retail inflation, as measured by consumer price index combined (CPI-C) was 6.6 per cent during 2020-21, breaching the Laxman Rekha or threshold level of 6 per cent. But with the revival of economic activities in the post Covid 2021, high inflation became a global phenomenon. For example, among developed countries, the US experienced inflation of 7 per cent in December 2021, the highest since 1982 and in the emerging economic bloc, Brazil suffered price rise of 10.1 per cent in the same month. Expectedly inflation at the rate of 6.6per cent became a source of major popular discontent leading New Delhi to take supply side measures and that tamed it to 5.2 per cent in 2020-21 till December.

But any comfort on inflation front unfortunately for the government and the masses proved short lived. Energy prices were already high when President Vladimir Putin sent his troops to Ukraine in an act of aggression on February 24. That sent oil and gas prices through the roof. As oil and gas and aviation turbine fuel invite very excise duty and also stiff levies at the state level, the two commodities not being covered by GST (goods and services tax), their prices are now greatly stoking inflation. Look at prevailing domestic LPG prices from PPP (purchasing power parity) dollar angle, truly reflecting the local currency’s purchasing power and the income level of average Indian, these are the highest in the world. As for petrol, we pay the third highest price only after Sudan and Laos. Indian oil marketing companies have started buying Russian crude at discounted rates.

As is to be expected, Indian buying of Russian crude has not gone down well with Western nations sanctioning the aggressor country on a growing number of counts. For example, the US has banned all energy supplies from Russia and the UK is working on phasing out oil and coal of that origin by yearend. Whatever sins Russia may be committing, India has deep political and economic ties with that country and the world is aware of that. India has served notice that it will continue to buy crude oil from Russia to protect its own economy.

In any case, fuel prices continuing to rise to new record levels are having an inevitable domino effect with food, edible oils and stationery prices getting revised periodically in sync. A survey conducted by the leading Bengali daily Anandabazar Patrika of families in the monthly income bracket of ₹15,000 to ₹45,000 about how they are coping with the sudden major spurt in inflation found one common answer that even after doing with less of every single item of food and other daily necessities, their savings are going for a toss. Some have lost the capacity to save. Others have started using up what they saved in the past. Experiences of families with identical income or even a little more in other parts of the country are either faring the same or even worse. If this is the condition of people with a regular income, whatever is the size, then think how badly the ones who lost their jobs during the Covid and never got them back or whose deep salary cuts are still to be restored are doing.

Mercifully, the unemployment rate, according to the Centre for Monitoring Indian Economy (CMIE), has started declining with economic activities slowly gathering steam. CMIE’s monthly time series data shows unemployment rate was down to 7.6 per cent in March from 8.10 per cent in February. Economist Abhirup Sarkar, however, makes the pertinent observation that even “this unemployment rate is high for India which is a poor country. Poor people, particularly in rural areas cannot afford to remain unemployed, for which they are taking up any job that comes their way.”

Even while the overall national unemployment rate continues to fall, the ranks of unemployed in some states remain worryingly high ranging from 14.4 per cent for Bihar to 26.7 per cent for Haryana. The accepted fact remains inflation has a negative impact on growth and real per capita income. Inflation is not neutral. In no case does it support growth. That is why on the occasion of release of monetary policy the other day, Reserve Bank of India (RBI) governor Shaktikanta Das said: “In the sequence of priorities we have now put inflation before growth. For the last three years starting February 2019, we had put growth ahead of inflation in the sequence. This time we have revised that because we thought that the time is appropriate and that is something which needs to be done.”

Largely caused by Ukrainian war, the inflation outlook has worsened globally as also for India. RBI has revised upward its inflation forecast for 2022-23 to 5.7 per cent from the earlier 4.5 per cent. If the war persists and sanctions further tightened, raging inflation will not be doused. In fact, inflation here could very well cross the Laxman Rekha as the year progresses. If inflation stays this high what option could be there for RBI but to cut this year’s growth forecast to 7.2 per cent from the earlier 7.8 per cent. Inflation and growth outlook being so fluid, Das’ observation that “we are not hostage to any rulebook and no action is off the table when the need of the hour is to safeguard the economy,” is an important pointer to RBI monetary policy staying flexible.

Commodity prices across the board from oil to steel to aluminium and to copper have all significantly appreciated. This is particularly pinching for the micro, small and medium (MSME) sector, which has a share of around 30 per cent of GDP and provides employment to 111 million. High input prices have pushed up working capital requirements of the sector. Will that incremental financial accommodation be available from banks? Unlike large enterprises, most MSMEs don’t have reserves to fall back upon. New Delhi must see that the MSME sector having a share of close to 50 per cent of total national exports is able to walk through difficult times unscathed.

Industry as a whole has welcomed the government investing heavily in infrastructure projects creating demand for products of a host of industries. The combination of mega capital expenditure programme that hopefully will bring Indian infrastructure close to world class resulting in marked fall in logistical cost and supply side measures is the response expected from the government. Private sector too is not found wanting in announcing major investments and this is led by the steel industry with investment commitment of over ₹1,000 billion in new capacity building.

In the challenging circumstances, Indian farmers well deserve a pat on their back for agriculture and allied industries are expected to have recorded growth of 3.9 per cent in 2021-22 against 3.6 per cent in the previous year. There is no promise that the coming days will bring any relief. One may, however, see a silver lining in the Economic observation: “Despite all the disruptions caused by the global pandemic, India’s balance of payments remained in surplus throughout the last two years. This allowed the Reserve Bank of India to keep accumulating foreign exchange reserves (they stood at US$634 billion on 31st December 2021). This is equivalent to 13.2 months of merchandise imports and is higher than the country’s external debt. The combination of high foreign exchange reserves, sustained foreign direct investment, and rising export earnings will provide an adequate buffer against possible global liquidity tapering in 2022-23.”