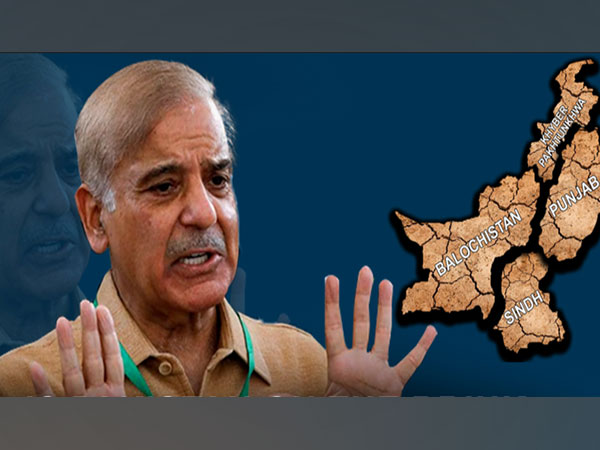

Bordering India, Afghanistan, Iran and China – Pakistan is comprised of four provinces – Punjab, Sindh, Khyber Pakhtunkhwa and Balochistan.

Pakistan also has a federal territory, the Islamabad Capital Territory and two occupied regions – Pakistan-occupied Kashmir (PoK) and Gilgit Baltistan, both parts of the erstwhile princely state of Jammu and Kashmir which had become part of India in 1947 and are now illegally occupied by Pakistan.

All these provinces and territories of Pakistan have diverse cultures, languages and ethnicities. Unfortunately, Pakistan has failed to keep them united.

The Punjabis, who are arguably the most prosperous of Pakistan’s ethnic groups, hold all major posts within the government, the army and the judiciary. They have been lucky to avoid many of the crises plaguing the rest of the country. These crises, which continue to persist, have fuelled sectarian and separatist violence.

Pakistanis have largely lost faith in the coalition government headed by Prime Minister Shehbaz Sharif, having failed to carry out any of the much-needed economic reforms in the country.

Naveed Baseer, Expert on Pakistan says, “People are not happy with the Pakistan government or Pakistan system or whatever the army is doing, whatever the judiciary is doing. They are totally not happy and they are looking for such movements that can come up and lead them.”

The Baloch are living as minority on their own land and continue to face persecution at the hands of the Pakistan Army and spy agency, the ISI.

With Pakistan’s financial crisis owing to rising debt and dwindling foreign exchange, the Baloch’s situation has become even more dire.

The separatist movement in Balochistan has intensified and opposition against Pakistan and its ally, China, has risen.

Today, several pro-independence organisations like Jeay Sindh Qaumi Mahaz (JSQM), World Sindhi Congress, and Jeay Sindh Freedom Movement have gained a wider support base within Sindh and international platforms.

The Sindhis, who can trace their roots to the ancient Indus Valley civilization, have realized that by remaining integrated with Pakistan, their future will be uncertain and under threat and thus voices for a separate state have gathered steam.

Facing discrimination, extreme poverty, and loss of their Sindhi culture and language, the people in this part of Pakistan are determined to fight for their right for freedom.

“The historical nations particularly Sindhis, Balochs and Pashtuns are thinking that the only way is the emancipation of these historical nations” says Lakhu Luhana, leader of the World Sindhi Congress.

The Pashtuns, like the rest of disenchanted Pakistan citizens, have lost faith in the government, in particular with the ever-worsening economic situation.

Pakistan-occupied Kashmir (PoK) and Gilgit Baltistan, which have been under Pakistan’s forceful occupation since 1947, are also experiencing mass resistance to the Pakistani government. Cripplingly high inflation, food and medicine shortages, unemployment, and increasing distrust in the government are the key drivers behind the recent massive anti-Pakistan protests.

Pakistan has long exploited PoK and Gilgit Baltistan for their resources and has used the territories as breeding grounds for terrorism and has exploited their natural resources. This region is also used as a launchpad to push terrorists into India.

The continuing turmoil on both the political and economic fronts in Pakistan has led to widespread rebellion within the country. This risk seems imminent as the Pakistani rupee continues to sink to new lows against the dollar and every day is a struggle for survival for the large majority of the Pakistani population. (ANI)

Read More:http://13.232.95.176/